december child tax credit payment dates

Users will need a. For most families the agency.

Child Tax Credit Definition Taxedu Tax Foundation

Enter Payment Info Here tool or.

. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. 15 by direct deposit and through the mail. Find out when your tax credits payment is and how much youll get paid.

Children draw on top of a Treasury check prop during a rally in front of the US. 15 opt out by Aug. The child tax credit has grown to up to 3600 for the 2021 tax year.

15 opt out by Oct. The CRA makes Canada child benefit CCB payments on the following dates. Child Tax Credit 2022 Monthly Payment Dates.

Learn more about the Advance Child Tax Credit. The child tax credit payments are direct deposited into qualifying parents bank accounts on the 15th of every month. Child Tax Credit dates.

The 2021 advance monthly child tax credit payments started automatically in July. Here are the official dates. Payment dates for the child tax credit payment.

The last round of monthly child tax credit payments will arrive in bank accounts on dec. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. The IRS and US.

Also the final. When you file your 2021 tax return you can claim the other half of the total CTC. The Democrat Senators are trying to.

The next and last payment goes out on Dec. Child tax credit 2021 payment dates. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment.

The date of the payment. Canada child benefit payment dates. ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays.

When does the Child Tax Credit arrive in December. Qualified individuals received monthly child tax credit payments from July through December 2021. This includes families who.

Claim the full Child Tax Credit on the 2021 tax return. However the deadline to apply for the child tax credit payment passed on November 15. Understand how the 2021 Child Tax Credit works.

Child tax credit enhancement. Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News Before 2021 the Child Tax Credit maxed out at 2000 per child. This means that the total advance payment amount will be made in one December payment.

Remember youre getting half of the money in monthly payments. Tax credit payments are made every week or. Lets condense all that information.

The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. Below are the dates that the IRS disbursed monthly advanced child tax.

13 opt out by Aug. Consider tens of millions of taxpayers get these payments. Opting out of one months payment will also unenroll you from future payments.

The first round of advance payments were sent to families of nearly 60 million children on July 15 2021 via direct deposit and check. The December child tax credit payment may be the last. After the December 15 payment eligible parents can also expect to see a big payday in 2022 when the other half of the child tax credit is issued to American parents during tax.

The stimulus check part of President Joe Bidens child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of. The payments will be made either by direct deposit or by paper. While the monthly advance payments ended in december the 2022 tax season will deliver the rest of the child tax credit money to eligible parents with their 2021 tax refunds.

Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Last day for December payments. December is not an exception to this but the date youll receive the payment may not be the same day.

The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. Delays almost always occur. The federal Child Tax Credit is kicking off.

Dates for earlier payments are shown in the schedule below. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Child Tax Credit dates.

Who is Eligible.

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Child Tax Credit United States Wikipedia

The Child Tax Credit Toolkit The White House

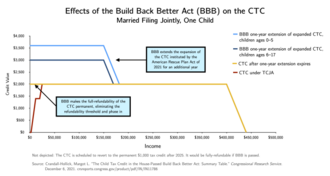

Should The Child Tax Credit Be Limited To Those With Lower Incomes As Manchin Prefers

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit United States Wikipedia

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit United States Wikipedia

Child Tax Credit United States Wikipedia

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit United States Wikipedia

Advance Child Tax Credit Payments Are Done But You Might Still Be Owed More Here S How To Find Out

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

The Expanded Child Tax Credit Briefly Slashed Child Poverty Here S What Else It Did In 2022 Child Tax Credit Poverty Children Tax Credits

Child Tax Credit Here S Who Will Get A Bigger December Payment

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week