tax per mile reddit

Ryan Stubbs Good morning. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

Paying By The Mile And Ending The Gas Tax

The infrastructure bill does not impose a mileage tax.

. My girlfriend is a traveling nurse and gets 45cents a mile but nothing for car allowance. There is no senior citizen discount on motor vehicle taxes. 585 cents per mile.

Shes definitely doesnt drive nearly as much as I do maybe 40 miles a day. IF they were sold and IF we are to believe the 2022 S Plus 32400 - 7500 rebate at 24900 for 226 miles of EV range would put it far above the. A mileage tax evens the playing field against EVs and might be better for people driving work trucks etc.

A spreadsheet is completely overkill. Few people volunteered for the programs initially. 56 cents per mile for business miles driven down 15 cents from 2020 16 cents per mile driven for medical or moving purposes down 1 cent from 2020 14 cents per mile driven in service to a charitable organization.

Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax. The timing of a vote on a 12 trillion infrastructure package divided House Democrats this week. Figure out how many dollars you make per mile you drive and then just do the math for your total earnings.

16 cents per mile. 18 cents per mile. 1 A pay-per-mile road tax rewarding people for driving less.

If your car gets 24 mpg now youd be paying 120 in tax based on mileage vs the 060 if paying per gallon. If you use the standard mileage rate deduction you cant deduct most of your actual car expenses but it also makes your calculations much easier especially if you dont have all your receipts or maintenance records. 005 per mile would end up as a massive increase in the taxes you are paying.

Gas tax hits harder on people with longer commutes and gives a free ride to Teslas and electric vehicles. For those 64 years old the fee is 41 every two years. Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively that yielded mixed results.

The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. No you dont get paid that much per mile driven but you can deduct that much on top of your standard deduction I believe. 3 Practical advice for drivers from the Government around lowering carbon emissions.

For the 2021 tax year the rates are. This includes 10 million each year from 2022 to 2026. 206 of the 611 vehicles in Oregon.

If i have to pay 500 in taxes and i get 2000 of refund i would net 1500 in refund after paying the 500. 2 Car tax to be ring-fenced and actually spent on improving our roads - not just for drivers. Either through increasing fuel duty or using mileage readings taken during an MOT.

56 cents per mile. If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022. I get 400mo in car allowance tax free plus 18cents a mile until I hit 2000 miles than every mile after that is 28cents a mile.

And 10000 in expenses reduces taxes by 2730. Rather this bill proposes a national motor vehicle per-mile user fee pilot program to study the impacts of. So how does tax refund per mile work.

In 2019 Oregon lawmakers expanded their VMT program and prohibited cars that get fewer than 20 miles per gallon from participating in the program moving forward. That pay a ton in gas taxes. Youre not going to get audited.

You can easily claim 1miledollar earned easily. Check DMV FEES with this link. American drivers could soon trade paying taxes on gas at the pump for owing the government annual per-mile user fees under a new pilot program recently passed by the Senate in Joe Biden s 12.

While Congress and the states kick around proposals to increase funding for infrastructure Robert Atkinson an opinion writer for The Hill has backed the idea of charging big rigs taxes based on the number of miles they driveCertainly not a new idea pilot programs for a per mile tax have been ongoing in several states although. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. You can push it.

The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee. Rates in cents per mile. Average is 150 miles a day.

Thats 12 for income tax and 1530 in self-employment tax. More efficient cars end up being nailed worse. Medical and moving mileage.

A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile. This rate fluctuates yearly and applies to vehicles including cars trucks and vans. Do i get 53c per mile in refund.

The 545 cent number is very generous since most uber drivers have 20k cars and if they drive 100k miles in a year there is no way vehicle expenses are 545k. And that money 1500 do i get it straight to my bank. 545 cent per mile is the IRS rate for 2018.

The screenshot shows bullets saying per-mile user fee estimated to be 8 cents per mile and amounts vary depending on vehicles Text above the screenshot adds the. DMV does offer discounts on the semi-annual license renewal fee for persons 64 years of age or older. For 2021 taxes the standard mileage rate is 56 cents.

Train Prices Per Mile Across Europe R Mapporn

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Stride App Review 2021 Is Stride Tax Actually That Great For Gig Economy Drivers

See The Range Of Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Tiktok Reddit And Instagram Entice Younger Investors International Adviser

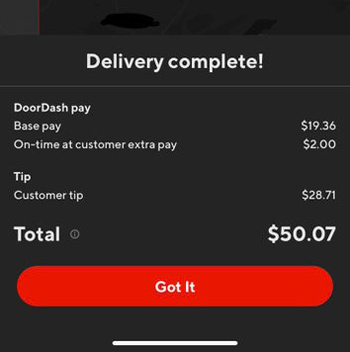

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

My Door Dash Spreadsheet Finance Throttle

White House Considers Vehicle Mileage Tax To Fund Infrastructure Buttigieg Says R Moderatepolitics

![]()

Stride App Review 2021 Is Stride Tax Actually That Great For Gig Economy Drivers

Grubhub Vs Doordash Pay 2022 What S Best For Delivery Drivers

Reddit Raises 250 Million In Series E Funding Wilson S Media

My Door Dash Spreadsheet Finance Throttle

Still Owe Larger Refund On Uber Driving Than Expected R Uberdrivers

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

The Absolute Best Doordash Tips From Reddit Everlance

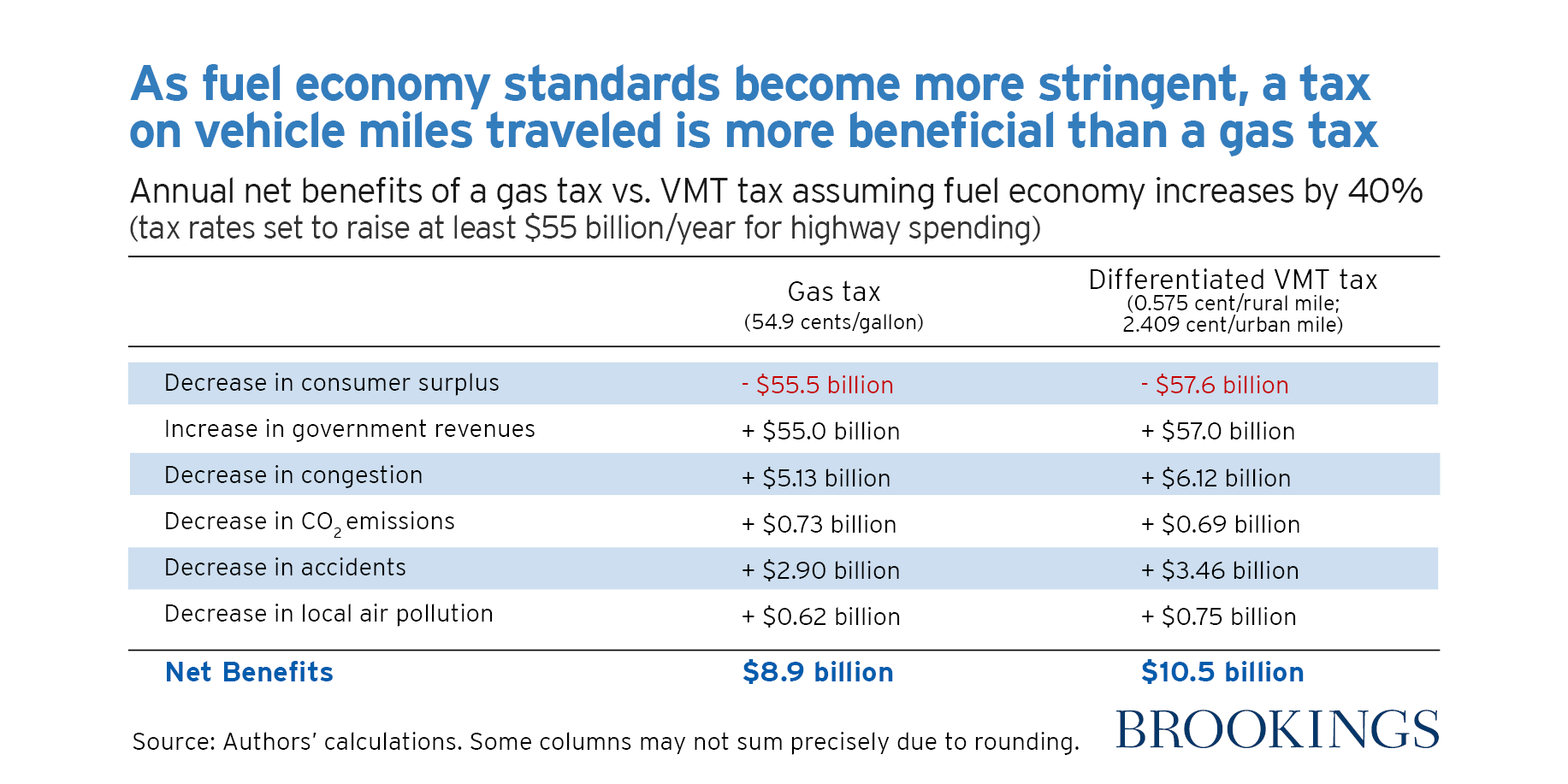

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver